HM Revenue & Customs on X: "Do you want to claim tax relief for your business expenses? You can fill in a P87 form in your Personal Tax Account https://t.co/rrv6L3dvrl https://t.co/S1yvrLjqzR" /

HMRC explains rules of new 'side hustle' tax crackdown on online selling and who is affected - Birmingham Live

HVP Magazine - HMRC tool launched to aid new end of tax year profit reporting requirement for sole traders

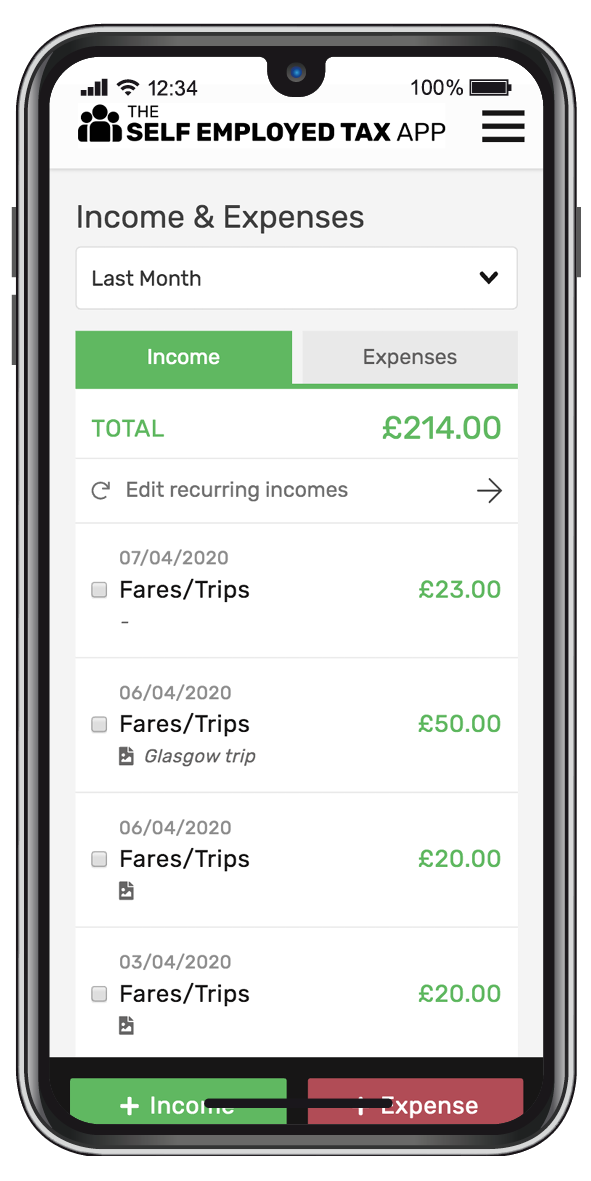

![Claiming Mobile Phone Expense - Self Employed Guide [2024] Claiming Mobile Phone Expense - Self Employed Guide [2024]](https://assets-global.website-files.com/5d71eeb2a19ee03e3430f50f/6606ad49134fc6f4224334de_limited-company-expenses.webp)